A study of the relevance of financial frictions for markup adjustments to exchange rate shocks.

We have used the Keynes Fund grant to conduct research into British firms’ international pricing behaviour. This has produced a working paper: “Invoicing and the Dynamics of Pricing-to-market: Evidence from UK Export Prices around the Brexit Referendum,” jointly authored by Corsetti, Crowley and the post-doctoral RA funded by the grant, Dr. Lu Han. The paper was submitted to the Journal of International Economics and the co-editor has invited us to revise and resubmit the paper.

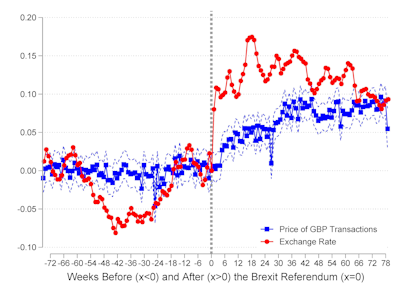

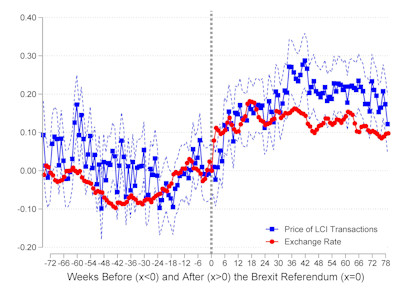

Analyzing the large and persistent sterling depreciation following the Brexit referendum, we provide novel and important microeconometric evidence that the currency in which a cross-border sale is invoiced predicts systematic differences in the dynamics of exchange rate pass-through (ERPT) and pricing to market. We find that, while ERPT is high for transactions invoiced in producer currency and low for sales invoiced either in a vehicle or in the destination market currency, these differences strikingly narrow within six quarters.

Notably, the weaker currency did not translate into a persistent gain in price competitiveness for UK exports.

Importantly, we find that firms price-to-market, i.e., adjust markups to bilateral exchange rate and CPI movements, only when they invoice sales in the destination-market currency---there is no evidence of market specific adjustment when invoices are written in pounds or a third currency (dollars).

Finally, we document that, at a granular level, UK firms invoice in multiple currencies---even when shipping a product to the same destination. In light of the fact that invoicing matters for pricing, we infer that firms appear to “differentiate” their price schedule by using a portfolio of invoicing-currencies across and within markets. Moreover, we document a nonnegligible degree of currency switching over time. A switch is especially relevant when going from pounds or dollars into a local currency because, as we show, in the local currency case firms pursue more pricing to market. Yet, the aggregate shares of invoicing currencies remain remarkably stable over time and in particular do not respond to the Brexit shock. These are novel and puzzling stylized facts brought to the attention of the literature.

The paper identified much richer and more complex variation in firms’ choices of invoicing currency and pricing behaviour than any previous study. In our original proposal we intended to proceed by linking international pricing behaviour to firms’ balance sheet data in order to explore how financial conditions shaped individual firms’ trade transactions and decisions. As of today, the first part of the proposal led to results that are much richer relative to the original planned investigation. This part of the project naturally required more resources and time to elaborate upon our initial ideas. As we were wrapping up our Keynes Fund study, for instance, we allocated some RA time to beginning a new study on UK firms’ international pricing that focuses on firm-level factors that influence the evolution of a firm’s invoicing currency choices over time. We also devoted a large amount of time to refining the novel econometric tools we used in the analysis. We will proceed with the second part in the near future.

We have created two research outputs, a paper: “Invoicing and the Dynamics of Pricing-to-Market: Evidence from UK Export Prices around the Brexit Referendum”, and a blog summarizing our results, “Dollars and sense: The sterling depreciation and UK price competitiveness”, at VoxEU.org.

The research paper was presented in seminars at: the Federal Reserve Banks of New York and Minneapolis; the Graduate Institute of International and Development Studies of Geneva; the University of Liverpool Management School, the University of Wisconsin-Madison; the National Institute of Economic and Social Research (London, UK); Fundacao Getulio Vargas - Sao Paulo School of Economics; Insper (Sao Paulo, Brazil); Ludwig-Maximilians-Universitat-Munchen; and the Cambridge Statistics Discussion Group. The research was also presented at the Central Bank Research Association Annual Meeting; the WTO's Conference on Updating Trade Cooperation; the Society for the Advancement of Economic Theory Conference in Ischia, Italy; and the CEPR Webinar on Trade & the Real Economy. A video recording of Dr. Crowley’s presentation at the WTO is available here, beginning at 2:22 on the counter.

Corsetti was invited to present the paper as a keynote in the 2019 Annual Conference of the Sveriges Riksbank, Stockholm (Business Cycles in Small Open Economies).

In the period covering the award and following completion of the project, Prof. Corsetti and Dr. Crowley have engaged with policymakers in the UK, US, and EU repeatedly to discuss the findings in this paper. Among a long list of high level panels, Dr. Crowley has testified before the UK House of Commons International Trade Committee and the UK House of Lords EU Select Committee. She has served on advisory panels and working groups for the UK Department for International Trade, the UK Department for Food, Agriculture and Rural Affairs, and the UK Government Office for Science. Prof. Corsetti has been awarded the Duisenberg Fellowship at the European Central Bank, where he is an academic consultant to the International Directorate General; he has been appointed as a visiting scholar at the Bank of International Settlement and the Federal Reserve Bank of New York; he was also invited to produce a technical paper on Debt sustainability by the European Parliament.

Invoicing and the Dynamics of Pricing-to-Market: Evidence from UK Export Prices around the Brexit Referendum

Invoicing and the Dynamics of Pricing-to-Market: Evidence from UK Export Prices around the Brexit Referendum, Giancarlo Corsetti, Meredith Crowley and Lu Han, Journal of International Economics, Vol. 135 (2022)

We provide micro-econometric evidence that, following the large and persistent sterling depreciation after the Brexit referendum, on impact, exchange rate pass-through (ERPT) was complete for transactions invoiced in producer currency and low for sales invoiced either in a vehicle or in the destination market currency. Yet these differences strikingly narrowed within six quarters. A weaker currency did not translate into a persistent gain in price competitiveness for UK exports. At a granular level we find that UK exporters invoice in multiple currencies—even when shipping a product to the same destination—and switch currencies over time. Remarkably, we fail to detect significant changes in the relative shares of invoicing currencies in response to the Brexit shock. Last but not least, we find that UK firms price-to-market, i.e., adjust markups to bilateral exchange rate and CPI movements, only when they invoice sales in the destination-market currency.

As noted above, the grant obtained from the Keynes Fund not only enabled us to undertake the proposed research, it also helped us to develop ideas for new projects. We are grateful to the Keynes Fund for providing a bridge over a temporal gap in funding between publicly-funded research grants. The Keynes Fund was instrumental in providing the necessary support to obtain a large fellowship award from the ESRC that is enabling us to further extend this research agenda.