In 2015, countries around the world rallied to set their nationally determined contributions to the Paris Agreement in which they laid out their plans at combating climate change. However, grave concerns regarding the distributional effects of climate change mitigation policies have challenged the public’s acceptability of measures that increase the price of carbon, as witnessed from recent events across the world (e.g. the gilets jaunes in France).

As such, in order for countries to implement sound policies to reduce emissions and transition into a low-carbon future, it is crucial to understand the economic and distributional aftermath of climate change mitigation policies. In a recent working paper (Cavalcanti et al. 2021), we evaluate the aggregate and distributional effects of carbon taxation across and within countries.

We develop a multi-sectoral general equilibrium Roy model with heterogeneous workers and endogenous human capital accumulation. On the household side, individuals in the economy live for two periods. In the first period, individuals draw an ability vector that determines their productivity for working in each sector of the economy. Individuals take into account relative wages and their sector-specific abilities to optimally choose: (i) in which sector to work, and (ii) the time and resources invested in schooling. In the second period, individuals supply their labour inelastically to the chosen occupation and consume. On the production side, the model economy consists of 18 distinct sectors, including four energy-producing activities: oil, coal, natural gas and green. There is also a final good sector.

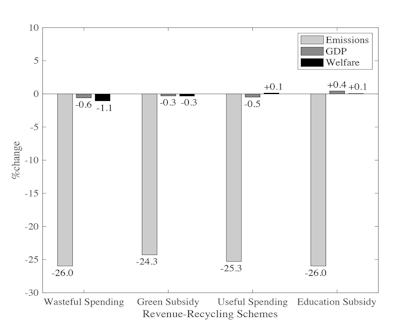

We introduce a carbon tax to the "dirty" energy producers, which in turn affects their prices. These changes in relative prices cascade to the rest of the economy through the intersectoral linkages and induce sectoral reallocation of inputs including labour. The overall impact of the tax will depend on the size of the tax and on whether and/or how the tax revenue is rebated back to the economy.

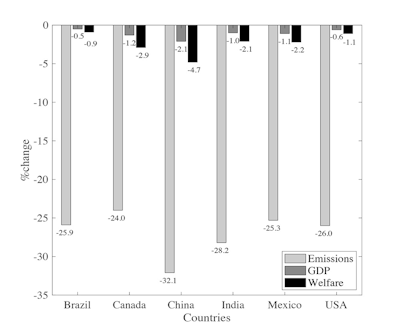

We start our quantitative analysis with the United States and estimate that a carbon tax of 32.3% is needed for the US to achieve its original Paris pledge of 26-28% emission reduction. This carbon tax costs the United States at most a 0.6% drop in output, which is the worst-case scenario when the government does not recycle its tax revenue.