Startup valuations – particularly of so-called unicorn companies valued at over $1 billion – have been skyrocketing for years, to a point where some commentators have been calling the development a ‘unicorn bubble’ or a ‘Dotcom 2.0 bubble’. Much of the ecosystem has been driven by scaling digital businesses fast without considering unintended societal or environmental consequences. Economists would describe this is as a market inefficiency of ‘mispricing’ at best and market failure at worst. Now, over the last year, the venture capital (VC) and startup ecosystem has started to show increased interest in ESG (environmental, social, governance) principles, slowly implicating a shift in the incentive system. Often driven by European state players, at least partly based on more general responsible investing or green agendas, VC investors are starting to ‘price in’ certain environmental, societal and governance risk factors. How does this change in incentives (for General Partners but also startups) influence the (price) inefficiency and overall investment behavior and decision making? In other words, is ESG bringing about not only narrative-change, but does it also have an impact on the price-making and valuation in the startup and VC ecosystem, possibly with deflationary effects?

In this project, focused directly on questions of market failure, mispricing and incentive systems at the core of the Keynes Fund’s goals, the project team collected primary empirical fieldwork and interview data with VCs to address the above questions. The team benefited from unique access to the ecosystem, leveraging fieldwork engagement with VCs since 2017 (in Silicon Valley, New York, London and Berlin). They were able to conduct and code 18 interviews with 20 investors (see table below for details), lasting on average 40 minutes. Interviews were conducted during the period May, 2022 – September, 2022 and looked to supplement the existing ethnographic evidence base of over 500 interviews with 250 VC partners. While most research on VCs is based on (large scale) quantitative datasets (e.g. Gornall and Strebulaev 2015) or (behavioural) experiments (e.g. Huang 2018, Kanze 2019), this research generated qualitative, narrative-based data1 which is a strong starting point for theorizing emerging phenomena, such as the impact of ESG on VCs (and valuations).

Supported by a research assistant, the primary goal of the project was to follow an invitation to submit a paper on the topic to the Cambridge Journal of Economics to further the academic understanding of the impact of ESG. This paper is currently being prepared and we hope to submit to the journal early next year, with commitments to also producing an ‘industry white paper’ (shorter, more accessible language and journalistic writing), which can be presented to a group of VCs to disseminate our findings and continue the dialogue.

1The raw data from interviews can for confidentiality reasons not be shared but we will make available clean interview transcripts in a second step of the project to others to use and scrutinize.

While the startup ecosystem, particularly in Silicon Valley, was founded around utopianism and hippie culture (O’Mara 2019, Nicholas 2019), for the last decade libertarian billionaires have ruled. The ethos of blitzscaling unicorns (i.e. quickly growing companies to $1bn valuations and beyond) in search of fast returns (Hoffman 2019) has since spread across the (Western) startup world leading to what some call a unicorn bubble (Janeway 2015, CNBC 2021). At the same time, as an increasingly broad base of business insiders is calling for capitalism to focus more on purpose (FT 2019) and stakeholders (Business Roundtable 2019), environmental, social and governance factors are starting to be taken seriously by VC investors and startups (Lenhard 2021). How is this shift – incorporating previously ‘unimportant’ (and mispriced) unintended consequences, e.g. on the environment or society (e.g. gig workers) – going to affect, or be affected by, skyrocketing startup valuations? Are the underlying bottom-line incentives (i.e. the ones which are impactful for financial returns) really going to change and hence influence the behavior of VCs?

Generally speaking, Beckert explained, in a recent CJE paper, how venture capital valuations come about, in terms of price and quality decisions, within a communicative field model; Beckert’s starting point is the observation that VCs decision making is based on subjective judgments and assumptions to make sense of “an uncertain future [startup] value” (ibid:294). We look to supplement this observation with post-Keynesian theory, exploring how investment decision rely on animal spirits, where rational quantitative calculation alone cannot justify action under uncertainty (Dow and Dow 2011).

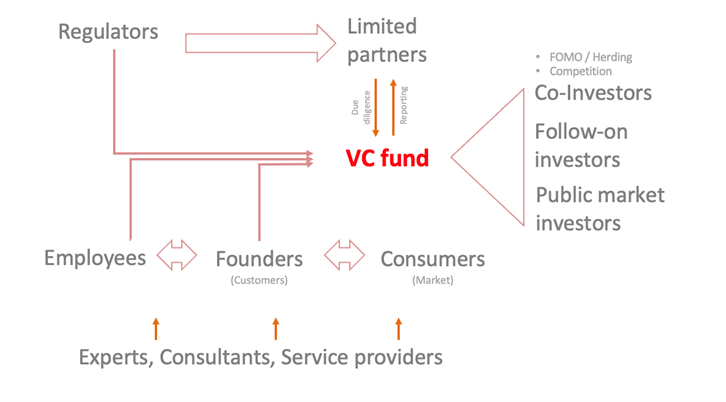

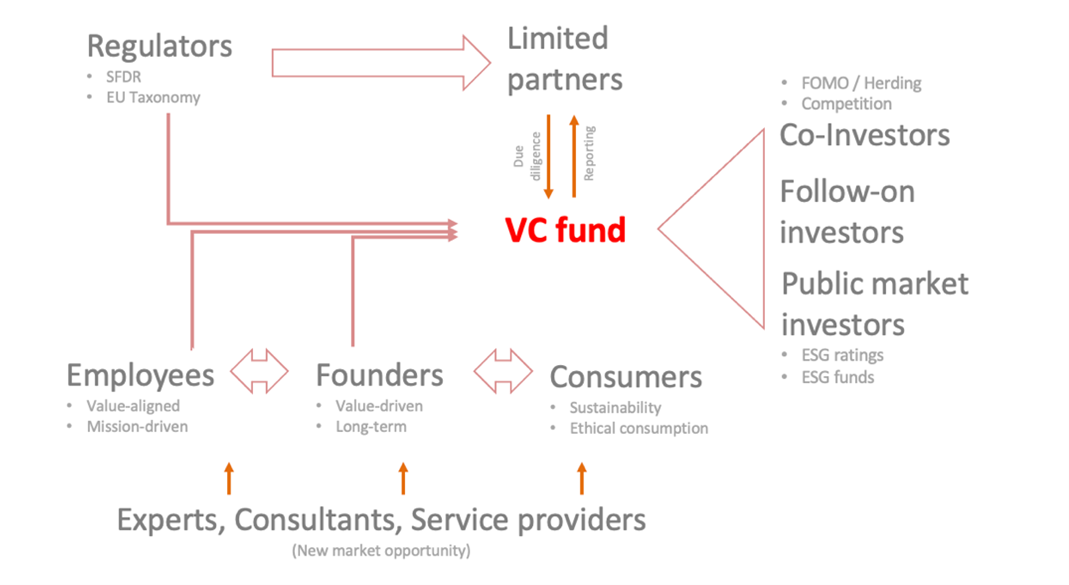

Beckert – similar to other commentators on financial actors such as Leins (2018), Tuckett (2011), Appadurai (2015) and Holmes (2013) – first focuses on the narrative (pitch) the entrepreneurs present to the investor; VCs invest based on how credible this narrative is and how strong their conviction grows as an effect. Most crucially, Beckert describes how conviction is not built up by the investor in a vacuum but within a ‘field’ of startup founders, their customers, consultants, scientists, experts, competitor founders and fellow investors. In this “community of experts”, through ‘intersubjective processes’ of communication (ibid.:295), VCs build up confidence about a narrative, supplementing reason and evidence with other sources of uncertain knowledge2 (Keynes 1937), leading to the eventual valuation and decision whether to invest.

2Keynes characterizes these sources of uncertain knowledge as ‘conventional knowledge, the knowledge of experts and reliance on past experience’.

Based on this model, which corresponds both to my four years of empirical observations and to the classical economic-sociology understanding of VC valuations Shapin (2008) put forward and the historical view of Nicholas (2019), we asked a specific question in this project: how was VC decision making (and due diligence) influenced by the recent unicorn bubble (and the following deflation)?

We explored how what could become an ‘ethical change’ (Robbins 2012, Laidlaw 2014) in the VC ecosystem towards ESG and due diligence was influenced by ‘the unicorn bubble’ (what some might describe as a price inefficiency or even market failure). While overall, culture and value change could be driven by the three core players in the startup ecosystem – founders, asset owners (limited partners or LPs) or venture capital investors –this explorative study focused only on VCs and their interaction with the other players in the light of both markets and ESG. We found four emerging themes. The first was that the recent ‘unicorn bubble’ saw the speed and cadence of venture deals and capital deployment soar. The amount of time spent on a deal impacts the number of people an investor consults and the depth and vigour applied during due diligence. The unprecedented speed and higher cadence lead to less diligence and ‘easier’ decision making. The second centred around the shift of power, away from LPs and towards entrepreneurs. The higher levels of money in the system distributes power differently; we found that ‘the wave’ lifted everyone up putting power into the hands of the entrepreneurs and increased ‘pressure to deploy’ from LPs. The VCs increasingly saw themselves as price takers and more prone to a fear of missing out (FOMO) and hype.

A third finding surrounded the consequences of lower pricing in the earlier stage markets. Later-stage funds and follow-on investors (or ‘tourist’ investors) were seen to have come down (to earlier rounds) and in (to VC) during a ‘hot market’. Later stage funds see early (cheaper) rounds as ‘options’ on later rounds, whilst conducting less diligence on theses ‘strategic’ investments. Finally, it is apparent that in parallel to the bubble and deflationary trend in the market, ESG has become an important force in the (European) ecosystem. Regulatory changes are requiring ESG due diligence and reporting, which will be easier to implement in the downturn and establish another layer of risk-mitigation. The communicative field model will increasingly look like this:

We are only now in the process of writing up the academic paper; no impact activities have happened so far based on the findings from the Keynes project but we are interested in exploring opportunities to

- Write journalistically and comment on the developing market environment (the continuing de-bubbling in venture capital).

- Bring stakeholders together to present our findings once the academic paper has been drafted, submitted and published as a working paper.