Individuals face risk in the form of shocks to their income, health, and wellbeing. In a world of complete and perfect capital markets, transitory income shocks do not affect the optimal consumption path. However, due to issues of moral hazard, adverse selection and limited enforcement, financial markets are far from being complete.

In this proposal, our main goal is to investigate how credit market imperfections, which generate a wedge between loan and deposit rates, affect the ability of agents to smooth consumption and insure against income shocks caused through, for instance, loss of employment or expenses shocks (e.g. health shocks and divorce). We will contribute to the existing literature in two ways.

We estimate the model using (i) the same aggregate data customarily used in the DSGE literature, as well as (ii) information on the cyclical evolution of the cross-sectional standard deviation of labor income and post-tax income from the Current Population Survey and (iii) a priori information based on microeconomic studies on aspects of the model that affect the interaction between its cross-sectional and time-series behavior (MPCs and higher moments of the income distribution).

1. Empirical Contribution

We will use the Brazilian Public Credit Register, which is a confidential loan level data set, which covers all credit operations in Brazil from January 2012 to December 2019. It contains detailed information on loan amount, loan maturity, risk, default rates and interest rates (CIS - Credit Information System, managed by Central Bank of Brazil). We will combine this dataset with Brazil's linked employeremployee administrative data set (RAIS - Relação Anual de Informações Sociais) to understand how loan interest rates and loan volumes vary depending on individuals characteristics and labour market income shocks.

Recent papers have focused their attention on heterogeneity in returns to financial and physical capital (see Benhabib et al., 2011; Benhabib and Bisin, 2018; Gabaix et al., 2016). Dispersion in returns does not arise merely from differences in wealth allocation between safe and risky assets: returns are heterogeneous even within asset classes and positively correlate to wealth (Fagereng et al., 2020). We will also study heterogeneity in interest rates but focusing on borrowing rates instead.

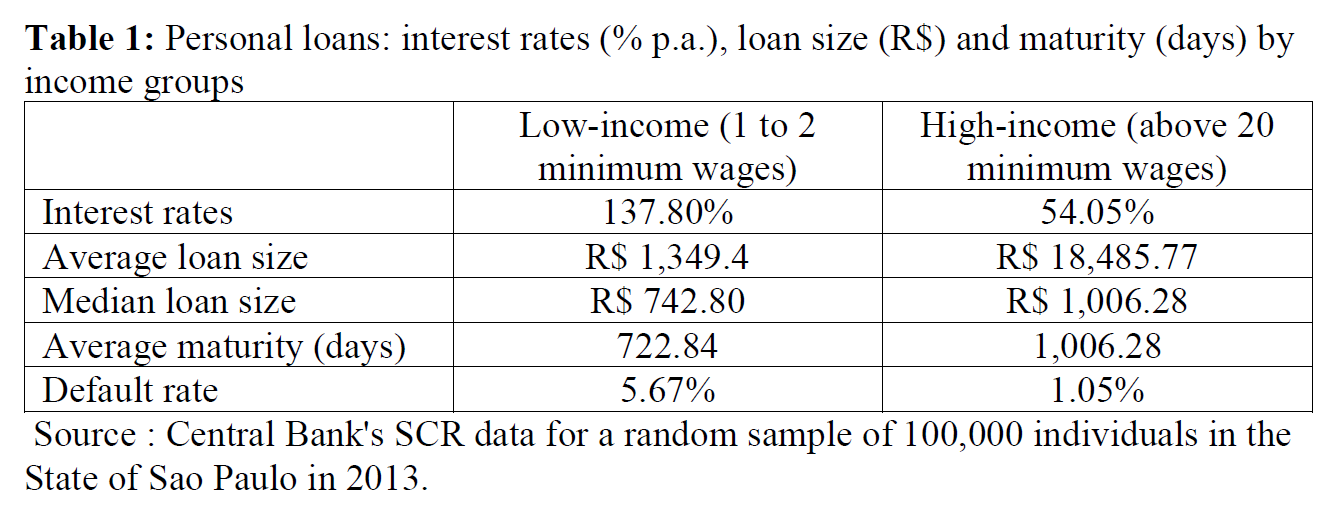

Our preliminary findings with a random sample of 100,000 individuals from January 2013 to December 2013 – we are using this random sample to construct our Stata do-files in order to implement our empirical analysis in the larger dataset - suggest that interest rate on personal loans are high and quite dispersed. High-income individuals pay substantially lower interest rates. Table 1 shows that the average annual interest rate for those earning more than 20 times the minimum wage is 54%. On the other tail of the income distribution, those earning between one and two times the minimum wage pay over 137% in a personal loan. Richer individuals borrow more: the median loan amount for high-income individuals is about 13 times larger than the median loan among individuals earning one to two minimum wages. Moreover, high-income individuals face a longer maturity; which is about nine months longer. The higher interest rates paid by low-income individuals may (partially) reflect a higher risk of default among this group of individuals. The last row in Table 1 confirms that this is indeed the case. Low-income individuals have a 5.7% default probability whereas that number is only 1% for high-income individuals. These default probabilities are quite low for all groups nonetheless(1).

This analysis and in-depth investigation will be extended to a large sample of individuals using the universe of all loans originated by banks from 2012 to 2019 in Brazil. We will document how loan interest rates vary by individuals conditional on detailed observable characteristics, such as income, age, gender, race and risks (those assessed by banks). From our knowledge of the literature, this will be the first paper to show this type of analysis using such detailed datasets. The most related paper to our research is Herkenhoff and Raveendranathan (2001). This is important since most of the models with heterogenous agents and idiosyncratic labour income shocks assume only one loan interest rates (e.g. Hugget, 2993; Aiyagari, 1994); and when more than one interest rate are considered, then they assume that loan interest rates reflect only default probabilities (e.g. Chatterjee et al., 2007; Livshits et al., 2007). This does not seem to be the case based on the Credit Register data from Brazil.

2. Model-Based Contribution

Consumer credit allows individuals to smooth their consumption over time when they are subject to income shocks. This is important not only for individual welfare but also for the propagation of macro shocks into the economy, since the Euler equation is a key determinant of the marginal propensity to consume. We aim to understand how the observed pattern on loan interest rates affects consumption inequality, consumption smoothing and marginal propensities to consume out of fiscal transfers.

In order to accomplish that, we will develop a model in which individuals are subject to income shocks and smooth consumption by making deposits at a financial intermediary in good times and running down credit balances or getting loans in bad times. More precisely, individuals can save and borrow by means of one-period pure discount bonds, which are intermediated by banks. Individuals can default on their loans and interest rates might vary to reflect default probabilities, risk premium and other factors, such as intermediation costs and intermediary mark ups. We will use our rich individual-loan level data to identify these factors shaping loan interest rates, such that our model will match key moments related to default rates, prices and loan amounts. With the internally estimated version of the model, we will assess the economic implications of loan interest rate dispersion on consumption smoothing and marginal propensities to consume.

Our research will provide a key input to the understanding of individuals’ ability to smooth shocks. By disciplining our intertemporal decision model using loan level data and exogenous variation on labour income shocks, we will add credibility to our counterfactual predictions. While the proposed project will focus on Brazil, we believe that some of the findings might be similar to other countries. A different strand of the literature focuses on dispersion in borrowing rates from the firm's perspective. Gilchrist et al. (2031) provide evidence on dispersion in borrowing costs among large (Compustat) firms in the United States. Bai et al. (2018) report similar evidence for Chinese firms whereas Banerjee and Duflo (2005, 2010) document that this is a pervasive characteristic of credit markets in developing countries. Cavalcanti et al. (2021) document substantial variation in financing costs for corporate credit in Brazil and show that such variation has important effects on firm dynamics and development. We contribute to this literature on dispersion in borrowing costs by focusing on consumer loans in a credit market for a developing economy (Brazil) and analyze the welfare and macro implications of this dispersion.

We believe that our research would have great policy relevance to broader debates about welfare and inequality, not just in Brazil, but also in other countries characterised by poor levels of financial development.

(1) Assuming that banks cannot recover any amount of non-performing loans, perfect competition for every loan, no transaction costs and that the average deposit interest rate in Brazil was roughly 10% in 2013, then the loan interest rate for low income and high income individuals would be 13% and 10.5%, respectively. Very different from the observed rates shown in Table 1.