Economic uncertainty is an important driver of economic activity. Businesses tend to respond to uncertainty by cutting investments and hiring, whilst consumers delay major purchases. Additionally, uncertainty can feed through to business cycles by increasing risk premia on financial assets, thereby tightening financial conditions. Having long run measures of uncertainty can help better assess the drivers of business cycles.

We construct news-based measures of economic uncertainty from 1850 to 2013 for the UK based on three leading newspapers with significant business content (The Times, The Guardian and the Economist). Our starting point is to extend measures based on word and article counts relative to the method by Baker et al. (2016), which uses a narrow set of words to identify uncertainty in news articles. We use a larger word list by Loughran and McDonald (2011), weighted using standard methods in natural language processing. This helps avoid binary outcomes where news content is either labelled as uncertain or not.

We also introduce our preferred machine learning based measure, which uses methods from computational linguistics research to quantify uncertainty. Spikes in our uncertainty indices correspond to key political and economic developments, providing qualitative support for our series. Empirically, we show that shocks in uncertainty have a significant impact on real economic activity.

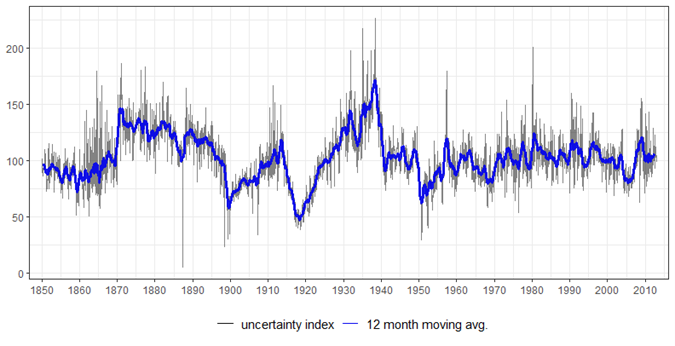

Our measure of uncertainty covers the period 1850 to 2013, for which other uncertainty proxies from implied volatilities or business surveys are largely not available. The chart below presents the whole index over time. There is a first trend of increase in uncertainty in the lead up to World War I, falling steadily towards the end of the war (this was partly driven by censorship). The index increases again in the lead up to the Great Depression. This is followed by further increase in uncertainty leading up to the start of WW2. Our text-based uncertainty indicator also spikes at key events such as the collapse of Bretton woods and the oil price shock in the 1970s, the early 80s and 90s recessions alongside the financial crisis in 2007-2009.

Our preferred, but more complex, measure derives from the computational linguistics literature, where significant work has gone into evaluating sentences for uncertainty. We train a machine learning model against human-tagged data on text expressing uncertainty, and then use the model’s predictions to score financial news articles for uncertainty.

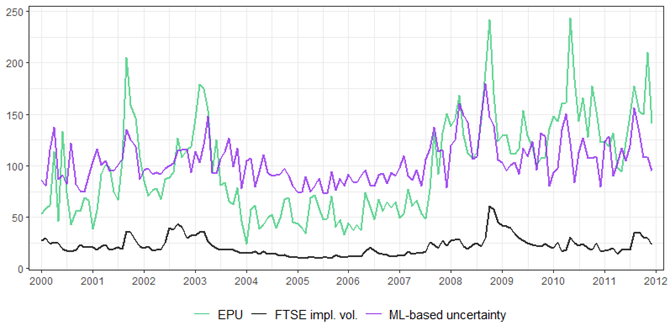

We show that this measure corresponds very well with key market moving events in 2000-2011 – years for which it can be compared to FTSE 100 implied volatility (earlier implied volatility data is unavailable). It also tends to capture key events during this period better than our text-based measure, with short-term spikes also better corresponding to implied volatility than the economic policy uncertainty (EPU) measure by Baker et al. (2016).

Figure notes: EPU stands for Economic Policy Uncertainty for the UK, which is provided by Baker et al. (2016). FTSE 100 implied volatility is derived from option prices. Our measure is standardised to have a mean of 100.

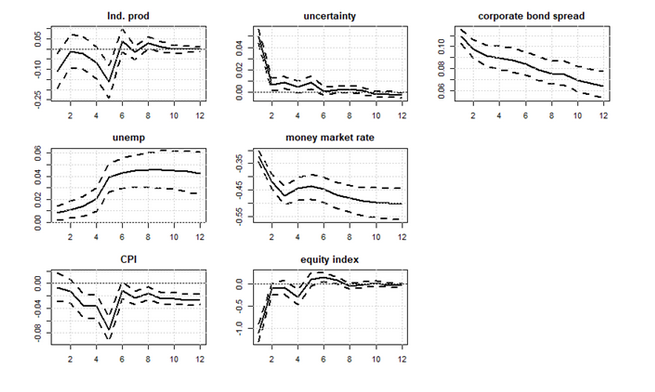

As a final contribution, we use study how shocks to uncertainty impact the real economy and financial variables. In line with previous literature, we find that uncertainty affects both. Industrial production declines and unemployment increases following an uncertainty shock, whilst corporate bond spreads also widen.

Figure notes: EPU stands for Economic Policy Uncertainty for the UK, which is provided by Baker et al. (2016). FTSE 100 implied volatility is derived from option prices. Our measure is standardised to have a mean of 100.

The research conducted helped us refine existing measures of economic uncertainty for a long historical span, for which few alternative proxies are available. Using machine learning made our approach more detailed and consistent with recent developments in computational linguistics. We also show uncertainty has tended to affect economic and financial conditions.

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics,131(4), 1593-1636.

Loughran, T., & McDonald, B. (2011). When is a liability not a liability? Textual analysis, dictionaries, and 10‐Ks. The Journal of Finance, 66(1), 35-65.

Uhlig, H. (2005). What are the effects of monetary policy on output? Results from an agnostic identification procedure. Journal of Monetary Economics, 52(2), 381-419.